Kundendienst

Copyright © 2025 Desertcart Holdings Limited

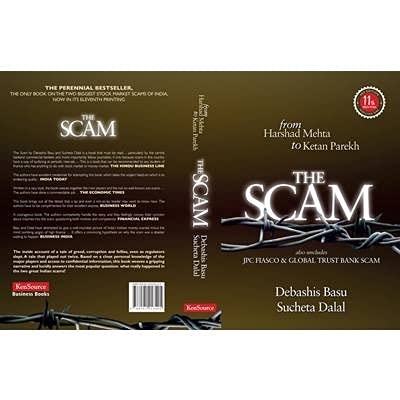

desertcart.in - Buy The Scam: From Harshad Mehta To Ketan Parekh Also Includes Jpc Fiasco & Global Trust Bank Scam book online at best prices in India on desertcart.in. Read The Scam: From Harshad Mehta To Ketan Parekh Also Includes Jpc Fiasco & Global Trust Bank Scam book reviews & author details and more at desertcart.in. Free delivery on qualified orders. Review: Good book - Good book Review: Nice Book - Nice book.. everything explained and detailed in lucid manner... Everyone exposed👍

| Best Sellers Rank | #77,246 in Books ( See Top 100 in Books ) #1,019 in Analysis & Strategy |

| Country of Origin | India |

| Customer Reviews | 4.4 4.4 out of 5 stars (684) |

| Dimensions | 20 x 14 x 2 cm |

| Edition | 11th Edition |

| Generic Name | Book |

| ISBN-10 | 8191013401 |

| ISBN-13 | 978-8191013405 |

| Item Weight | 480 g |

| Language | English |

| Net Quantity | 1.00 Count |

| Print length | 448 pages |

| Publisher | KenSource |

A**R

Good book

Good book

A**G

Nice Book

Nice book.. everything explained and detailed in lucid manner... Everyone exposed👍

V**D

Excellent thoroughly researched book about series of scams with various players which included banks, brokers, PSUs, financial institutions, sloppy regulation and the underlying incentive structure.

Although Harshad Mehta became the central villain of the scam that was exposed in the year 1992, this 1992 scam is a series of scams with various players involved Harshad Mehta, Ketan Parekh, banks, brokers, PSUs, financial institutions, sloppy regulation and the underlying incentive structure. The flawed banking policies & regulations, and the short-sighted policies of the government created loopholes & incentives that resulted into so many scams which ultimately busted in the year 1992 with the expose of Harshad Mehta by Sucheta Dalal working in Times of India. Harshad Mehta Scam The story of Harshad Mehta in the market started as a jobber in a brokerage firm. Then through experience, contact & influence, he got the brokerage license from the Bombay Stock Exchange. Later on, he also established his own asset management company Grow More. The eternal greed for money exploiting loopholes in the system led to his exponential rise and exponential fall. Harshad Mehta used banking funds to drive/rig the stock market using loopholes in the banking system. These loopholes of using banking & PSU funds to manipulate/rig the market were very much in practice by foreign banks like Citi Bank, ANZ Grindlays, Bank of America & influential brokers at that time. They sourced money from portfolio clients, financial institutions i.e. UTI, mutual funds & used it to manipulate market. A certain percentage of funds/deposits by banks are required to be kept as government bonds i.e. SLR as mandated by RBI. If there is an issue in complying the SLR requirement, the banks can fulfill the same by buying the government bonds from other banks having surplus government bonds. This interbank transaction i.e. money market does not take place directly, it takes place through a money market broker. Harshad Mehta was one of the brokers of money market. The transaction between banks i.e. purchase & sell of government bonds through brokers used to be settled in 14 days, and in that period, money used to be kept in the account of broker. Harshad Mehta started using that money and started investing in a selected stocks & rigging the market. The massive buying of selected stocks using banking funds by Harshad Mehta resulted in astronomical rise in the price of few stocks. Rotating the money between various banks and the stock market, he made huge return in a small time period. The transaction between banks could also take place through issuance of bank receipts rather than physical transfer of government securities. Having established deep connection with banks, Harshad Mehta bribed bank officials to issue fake bank receipts or withdrawing banking funds manipulating figures related to bank receipts in the registers of banks. The financial jugglery of Harshad Mehta was exposed by excellent investigative journalism of Sucheta Dalal. This expose of nexus between banks & brokers disrupted the rotation of money that Harshad used to carry between banks and stock market, and earning supernormal returns. The stock market started crashing and the value of shares that Harshad held also crashed. The banks that gave money to Harshad Mehta started demanding money, but as the stocks of Harshad Mehta collapsed, he was unable to fulfill the commitments of banks and he started defaulting big time. In this scam of using banking & PSU funds to manipulate/rig the stock market, thousands of investors lost money in the market. Investigation & witch-hunts with thrilling twists & turns by Reserve Bank of India, Central Bureau of Investigation, Enforcement Directorate, Income Tax Department, Joint Parliamentary Committee is very much described in detail in the book. Short-sighted policies that incentivized scams The flawed banking policies, over-regulation on paper, not upgrading the infrastructure required for record keeping & processing large number of market-based transactions (Public Debt Division of RBI) created the loopholes in the system for ease of doing scams rather than business during 1980s. Till 1992-93, 38.5% of the deposits with banks were required to be maintained as SLR, 25% CRR. 40% of the remaining 36.5% i.e. 14.6% were prescribed for priority sector lending. The loan melas very much prevalent during that time resulted into reckless political lending. Only 60% of the 36.5% i.e. 21.9% could be given as pure commercial lending. The reckless political lending led to increase in Non-Performing Assets (NPA) of the banks. Banks had no money left to finance capital-intensive Public-Sector Undertakings (PSUs) like NTPC. Therefore, PSUs were asked to borrow directly from the market issuing bonds. Till 1991, PSUs had issued bonds over Rs. 20,000.Banks were allowed to accept deposits free from SLR & CRR obligations under Portfolio PMS from any institution having surplus cash. Through this route, money that could be easily raised by PSUs started flowing into the stock market through collusion between banks, brokers and financial institutions.

N**N

Review about the scam of 1992

This is the best book for those who really wants to know what happened back in 1992

A**R

Reality

Good one for those who wants to know the real world of indian financial market.

J**J

Fascinating and must read

Highly recommend- actual history of the stock market saga written in an easy to read but gripping manner.

B**V

Good read but heavy on details

Appreciate the authors. I am amazed at the amount of work they hv put behind piecing all the facts n presenting it to common man in understandable manner. Kudos

K**A

Outstanding Book for Securities Scam.

Outstanding book for anyone who wants to know how the Securities Scam happened in 1992 & 2001. Its written crisply with lot of details and anecdotes. Excellent read for students and followers of Financial and Stock Markets.

M**M

Sucheta Dalal will always have her place in India's journalistic pantheon assured being the reporter who broke the securities scam and exposed the malpractices in India's financial sector that were rampant in the frontier days when the economy was being liberalized. This book is a detailed explanation of the machinations behind the scam, going far deeper than the newspaper columns and naming names and laying bare the personalities that took advantage of the system - the system itself being so far from perfect that it actively promoted malfeasance. This is a story of personalities - and that's really good because in the public mind, this scam was reduced to one man, Harshad Mehta but as the authors conclusively show, Harshad was just one of (though probably the most successful) of financial market operators who made money through illegal routing of money. At the core of the scam, though the detailed explanation is quite dense, is the simple fact that the scam involved routing funds from the money markets and public sector companies (inter-bank transactions, PSU cash deposits) into the accounts of brokers who then used these funds to invest in the stock market and take the index to dizzying heights. The bull run of 1990-91 was achieved more by injecting funds from these avenues into the stock market and the practice was widespread - Harshad used the funds of SBI Bank, Citibank and other foreign banks used money from portfolios of PSU clients, NBFCs like Canfina got funds from non-descript cooperative and small banks - the entire saga is a sorry tale of collusion between banks and brokers to subvert the stifling controls which made profitable banking near impossible. No one comes out well in this story - Harshad has been pilloried and he died a man with a sullied reputation, but as the authors show, the complicity of many other players was far greater than the final punishments they endured. The Reserve Bank of India comes across as a slothful, bureaucratic organization which repeatedly ignored warnings from internal reports and didn't take action till it was too late, SBI and the other Indian banks are rightly castigated for having loose control systems that ended up serving the interests of their brokers rather than their deposit holders - but it's clear that the authors have the greatest condemnation and contempt for the foreign banks and in particular Citibank. Citibank was perhaps the dirtiest player in the market and when caught, they tried to brazen it out rather than take the blame. Their high-flying executives in India - who later became household names in other fields - like Jerry Rao, Aditya Puri, AS Thiyagarajan epitomized the 'ugly American' approach to banking - perhaps the fact that they were Indians with the backing of a foreign name emboldened them to undertake brazen and sneaky underhanded practices flouting all international norms of banking operations. The denouement of this tale is hardly redemptive either - while the Indian financial markets have undoubtedly been cleaned up in the past 20 years, the scam and the investigations that followed did not yield the widespread structural reforms that were required -the inquiry reports of various commissions were buried under voluntary and involuntary apathy (politicians were most likely involved in the scam at multiple points) and the Ketan Parekh scam that happened a decade later testified to the fact that there were still enough kinks in the system for unscrupulous operators to make profits. 10 years after the KP scam, the markets are cleaner still but it would be a brave man who would bet against future stock market scams. As a final note, this book is a very comprehensive and detailed investigation into the scam and is probably the best resource for understanding how the many threads and entities in the financial space were tied together to make the scam happen. However, for people without at least a rudimentary understanding of banking and financial market operations, it might be difficult to follow the details of what happened - you'd definitely need to understand repo deals, bonds and other money market terms before diving into this book. An overview section explaining these terms would have been much appreciated for the lay reader. Also, this book focuses exclusively on the scam, periodically dipping into certain incidents in the 1980s to provide context, whereas I believe that the genesis of this scam were in the extremely stifling regulations that the banking system was operating under and a chapter or two tracing the evolution of the banking sector in the 1970s and 1980s would have provided insights into the behaviour and motivation of different players that finally led to the scam.

A**R

This is a ridiculous thing to read, what you will find on public domains are clubbed together and spiced up some more to make it enticing (a miserable job doing that). Please spend your money on something readable and useful.

A**R

The book is presented as a collection of facts and there is no connection between the dots to understand the context of what is happening. I wouldn’t recommend it to anyone who is not from a financial background.

TrustPilot

vor 1 Monat

vor 2 Monaten